Throughout history, Letters of Credit (LCs) have played a vital role in helping businesses move from the local to the international stage. For as long as merchants have been sending their goods across the world, they would seek to protect themselves from shipments being lost or not paid for by distant buyers. At the same time, buyers would try to reduce the risk of paying for goods that might never arrive. Indeed, ancient LCs have even been discovered on clay tablets dating back to 3000 BC.

Without an LC, the buyer and seller must agree on one of two extremes: the buyer takes no risk and pays after receiving the goods on an open account, or the seller takes no risk and demands payment in advance before shipping. An LC offers a compromise – a guarantee to the seller that they will be paid before they lose control over their goods, and to the buyer that no payment will be made until they receive the goods. This has allowed for what was once impossible – the opportunity to trade with partners without full knowledge of their ability to deliver or pay.

This is especially helpful when the buyer and seller may not know each other. This lack of a pre-existing relationship coupled with other factors such as a difference in language, laws and customs creates an element of risk for both parties involved. An LC allows each party to work with their trusted local bank to help mitigate these risks and forge long-lasting commercial relationships.

But LCs can be hard to understand, with lots of paper, processes and jargon. This is perhaps one of the reasons they have remained unchanged for so many years and have not seen much innovation and growth. They remain powerful tools for those with experience using them, but there are fewer document experts around to support these transactions. If international trade is to continue its path of growth, transforming this product for the 21st century will be a key factor.

How it works

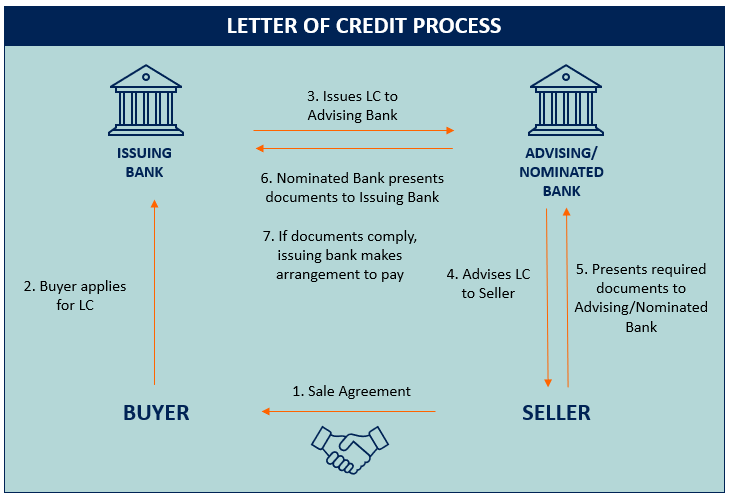

An LC forms a kind of financial bridge to facilitate a transaction, adding trusted banks and a trusted global process in between a buyer and seller with conflicting demands. The process starts with a buyer, who must apply for an LC to be issued on their behalf. In this application, they will state their conditions of payment – what is to be shipped, when and for how much.

Their bank – known as the issuing bank – will approve the request based on the buyer’s credit risk and then ‘issue’ the credit to the seller, through their bank of choice. Unlike the issuing bank, the role of the seller’s bank can change depending on the role that they have been asked to play. They may simply advise the seller on the terms of the LC (an advising bank), negotiate the LC on behalf of the issuing bank or accept a bill of exchange from the issuing bank (a nominated bank), or even provide their guarantee of payment to the seller (confirming bank).

Dealing with paper

The most important part, however, is the documentation. In an LC, banks do not deal in goods but rather the documents that underpin them. All obligations to pay from the banks are contingent against what is called a compliant presentation, or a set of documents that complies with all of the terms and conditions that the issuing bank has detailed, at the buyer’s request.

This document set can be as simple or complicated as the buyer sees fit, but the standard would include several commercial documents (invoice, packing list, etc.), government documents required for customs clearance (certificate of origin, phytosanitary certificate, etc.), and a transport document confirming shipment and title transfer (bill of lading, etc.).

This is just the beginning; many more documents are required for an LC, including insurance documents showing the necessary coverage, as well as independent quality surveyor certificates. Before long, you can have a stack of paper with well over 30 pages that need to be manually checked line by line against all terms of the LC.

It’s the seller’s responsibility to present these documents to the issuing bank through their local bank, in a courier bag. After being routed from seller to their bank, the documents will be checked if requested by the seller, and then couriered to the issuing bank, where the documents will be checked perhaps for the second time. If the documents comply, the bank will approve and their obligation to pay under the terms of the LC will now be in effect.

That could mean payment right away, or up to a year later. During this time, the seller can access a loan against the issuing bank’s acceptance at a lower rate than they could normally receive, given the bank’s comparatively lower risk (in most cases). The buyer may also seek a loan to settle the payment under the LC if they need time to sell the goods and receive payment from an end buyer. Occasionally, the documents from one LC are then forwarded under another in a back-to-back arrangement.

The advantages

LCs can be used by any corporate looking to export or import goods, and hundreds of banks around the world offer LC services. Large-value shipments, custom goods, time-sensitive deliveries, new trade relationships or transactions with higher risk countries may all be good candidates for an LC – suitable for both large and small businesses.

The LC process has been a reliable one and has remained relatively unchanged in over a century. As long as they can meet all the documentary requirements, an LC is perhaps one of the most secure methods of payment for exporters. The risk of non-payment is transferred from the seller to the bank (or banks) involved. Likewise, when a buyer uses an LC, they get a guarantee that the seller will honour their side of the deal.

When trading with new partners, or in an uncertain situation, sometimes the only opportunities for business or sourcing relationships for a business may be one with a lot of risk or one that takes advantage of an LC.

Where problems arise

So far so good, that is of course until you get to some of the details. Remember those documents that need to be submitted? Well, those pieces of paper (even today they are still usually physical paper documents) are often where the LC process gets slowed. Documents such as the bill of lading, bank drafts, as well as government and inspection certificates, require a physical element to their submission – often with proof of an ink signature or stamp.

If these documents are delayed or have errors, amendments to the original LC may need to be issued and approved, or else documents will need to be re-created and presented again. If the terms are not changed to reflect the documents as they are, even a minor change such as shipping one day late, can be reason enough for the presentation to be determined discrepant and the obligation to pay voided. This can result in delays of up to several weeks as buyers and sellers agree on what to do with the goods. For companies new to LCs, the chances of these issues happening increase, erasing the benefits of a process that should reassure parties and reduce risk.

Moving on with the times

In our modern age, employees are used to instant communication and digital applications in all areas of their lives, so the idea of waiting for two weeks for a paper document to be mailed is no longer justifiable. Digitisation of trade is the answer, and the LC has long been seen as the product set to benefit the most from this transformation.

Yet digitisation of LCs has lagged behind almost all other financial products due to a major problem – the lack of a global network. Where other products can digitise simply by connecting a bank and their customer, an LC requires a bank to connect with another bank, their customer and the other bank’s customer. There simply wasn’t a network like that in the world, until now.

Contour was born to create a global network of banks, corporates and sources of digital documents. Using the latest decentralised technologies and supported by the world’s leading trade finance banks and corporations, Contour is set to become the world’s trusted network for trade.

With a growing network seeking to solve various trade finance pain points, LCs have now become the easiest and most important product to digitise thanks to a globally common pain point, process, and data set.

Underpinned by existing ICC UCP rules that allow for digitisation, Contour will seed its network by providing intuitive workflows, digital communication and opportunities for digital alternatives to paper document requirements.

We have proven that document turnover can be significantly reduced by up to 90%, with all parties able to track and amend their documentation in real time. Furthermore, the nature of our technology makes it inherently audit-friendly and provides added transparency that can establish stronger and more trusting trade relationships between distant buyers and sellers.

While the demands of importers and exporters have changed over the past 100 years, the processes which underpin their operations have not. This is the mission of Contour – to build a new global standard by simplifying and removing barriers in the trade ecosystem, where everyone can collaborate seamlessly on one network.

To learn more about what our network can do for corporates and to join our network, click here.