Contour’s latest release, version 8.0, is a game-changing new architecture that features multi-identities for members. This ensures the network can realistically scale to all areas of trade finance with a flexible, low-cost, and decentralised web-based solution that will appeal to large enterprises (banks and MNCs) as well as SMEs.

Blockchain is in the news again…. but regardless of the challenges that are always inherent with a new and disruptive technology, the promise of a decentralised network for global trade is too powerful to ignore. And we have just achieved a breakthrough.

The appeal of a decentralised network

To recap the journey, a decentralised network for global trade and trade finance can finally remove barriers to entry, reduce operating costs, and free up working capital trapped in inefficient paper-based processes. But for it to work, the network needs to be big enough to support the world’s diverse set of trade banks and corporates.

In a networked product, the value is largely derived by the size and the quality of the network. The number one request we get from our clients is for ‘more members’ – not necessarily more features or products. Trade platforms, regardless of being based on blockchain or not, need to get big to match the scale of the global trade finance ecosystem.

Scaling a networked product is a challenge for many reasons, but for decentralised networks, there is an additional challenge that the technology itself poses.

“Global trade networks will never be able to scale without an element of decentralisation… an inclusive network must be flexible enough to allow banks around the world to connect to a common network while maintaining compliance with the various countries’ laws and regulations.”

– Josh Kroeker, CPO, Contour

Blockchain solutions vs. SaaS

What makes blockchain solutions different from traditional software-as-a-service (SaaS) platforms is that the data, software, and hardware are designed to be decentralised, so every new member to a network requires a significant setup process, with ongoing cost to support the software and hardware costs.

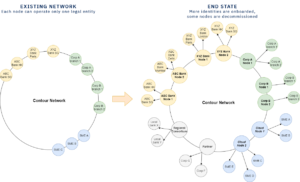

This is an example of pure decentralisation, with each member of the network operating their own independent node* on the network, and it is exactly how Contour has operated up until now.

Why scalability is not a concern at Contour

This fact has led some to conclude that blockchain networks will not scale efficiently and the industry should just build centralised cloud-based SaaS offerings. But this misses the point.

Global trade networks will never be able to scale without an element of decentralisation. The world does not have one set of banking regulations or laws to deal with data and data privacy. This necessitates that an inclusive network must be flexible enough to allow banks around the world to connect to a common network while maintaining compliance with the various countries’ laws and regulations.

A new, flexible offering

Flexibility to us means allowing both a pure decentralised model when it is necessary, and a lower cost SaaS offering when it is not – all connected on one decentralised network.

It started as an idea, but it is now a reality. By re-engineering our node architecture, we can now offer corporates and banks a choice between a low-cost offering on a shared service node (see membership plans), a dedicated node in any of our cloud locations, or the ability to self-host themselves anywhere they please.

Understanding what a node is:

To support this concept, we had to redefine what a node meant, and to create the concept of ‘multi-identity nodes’. These new multi-identity nodes do more than just help us scale.

Multi-identity Node Structure

How Contour’s network is now organised

Large banks and corporates can now plan how their entire organisations can join Contour and how to structure the web of legal entities, users, and country requirements. For example, one global bank may choose to have one node per region, with an additional node or two supporting countries with strict data localisation laws. Another large trading corporate may want just a single node supporting all identities, so that a centralised operations team can support any of their transactions across the group. There are no limits to how many identities one node can support, but a standard installation will easily support up to ten identities and if more are needed, a more powerful node can be configured.

To support these different requirements, we have added a new role to Contour – the Node Administrator. Once a bank or company decides to purchase a dedicated node for at least one identity, they will nominate a node administrator. The node administrator will have the authority to assign an identity administrator for each identity, and this administrator will have the responsibility of creating user roles for that identity and granting permissions to individual users from the pool of users across the entire organisation.

A powerful digital solution for all

What this means for us is that Contour now has an offering that can support everyone from an SME looking for a simple low-cost offering to the most complex organizations requiring data localization and customized user access. These options are now available on our latest release – Contour 8.0 – and we are excited by the potential this has for the entire trade finance and enterprise blockchain communities.

Contour helps corporates of all sizes transform and simplify their trade finance processes. Contact us to learn how our latest version can help your organisation digitise your Letter of Credit workflows.