When Contour launched in January, we could not have anticipated the tumultuous year that would lay ahead. COVID-19’s impact across the world has only exacerbated the inherent limitations in international trade networks and highlighted the need for an effective, digital, and common solution for banks and corporates.

As we near the end of this memorable year, we wanted to share Contour’s story and plans for 2021.

The barriers we look to overcome

Even before the pandemic, Contour sought to address the challenges associated with international trade finance: slow, paper-based processes, the need for a physical presence and the lack of interoperability between existing digital solutions, which add complexity, cost, and delays for both banks and corporates. When we began our operations, it was these key challenges we sought to combat, and continue to underpin the decisions we have made in our network.

Fundamentally, global trade lacks the infrastructure of an interconnected network that is needed to drive out inefficiencies, and the integration to support the wider elements of trade – such as contracting, post-trade fulfilment and customs – meaning that many operations exist in silos. These cause friction and unnecessary administration for importers and exporters.

This fragmented, process-driven system began to crack when most of the world went into lockdown due to the pandemic – paper documents failed to reach their destinations and staff were not in offices to receive those documents. Contour has recognised that banks and corporates have needed a method to digitise, not just to improve their paper-based processes – but to ensure business continuity in the event of crises such as COVID-19.

Beyond the pandemic and the impact of 2020, Contour continues to seek an answer to the underlying requirement for a global, digital network for trade – improving data transparency, enabling interoperability between all trade participants and being scalable to address the needs of different participants.

Throughout the year, Contour has worked towards achieving two outcomes: a growing decentralised network of banks, corporates and partners, and an application that can optimise processes central to international trade and trade finance.

Our strategy was to build a network by digitising existing processes first through innovating, not inventing something new. New solutions have occasionally focused too far into the future, without solving the problems that banks and corporates face today.

This is where Contour has led the way – working with a diverse group of industry participants and delivering a network that immediately benefits the trade finance ecosystem, while also being scalable and addressing the needs of different participants.

A year in review

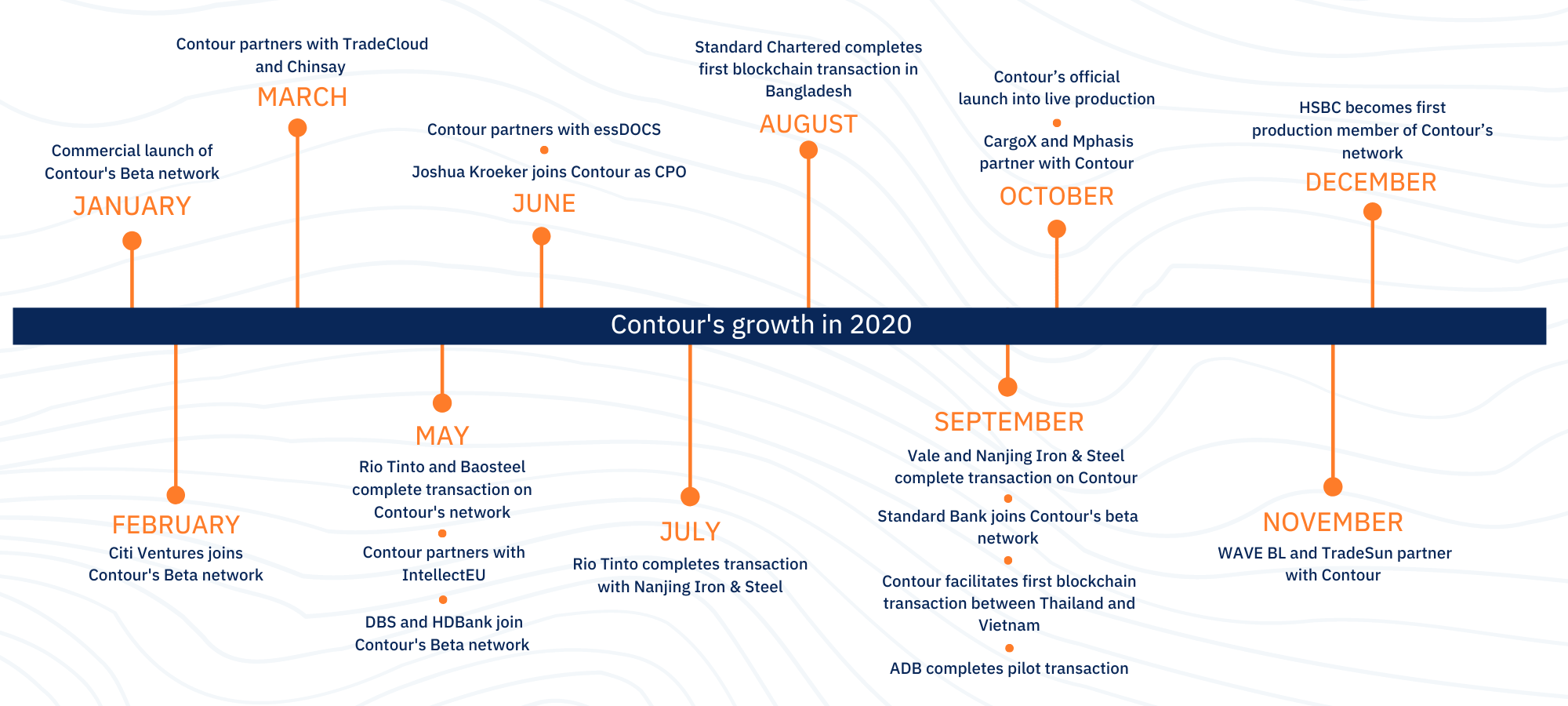

In its first year, Contour expanded its network and advanced its application into a production launch. In January, the network evolved from its consortium project with R3 into a fully independent entity, launching with the backing of major trade finance banks and technology firms. As part of the launch, we offered a Beta of our network to banks and corporates looking to transform their trade processes and be on the cutting edge of this exciting technology.

From there, we expanded our partnerships. Citi Ventures joined Contour in February as an investor, while Chinsay and TradeCloud became integrator partners to Contour’s network in March – enhancing our offering to the market.

May was a significant month for Contour, with numerous announcements that showcased the industry’s appetite for a network to support international trade. HDBank and DBS bank became the first banks on the network in Vietnam and Singapore respectively. Baosteel and Rio Tinto then conducted a transaction on the network, showcasing the attraction of Contour to China’s mainland and iron ore industry. Following this transaction, IntellectEU formally partnered with Contour to focus on the integration roadmap for banks and corporates.

The following month, Contour welcomed Joshua Kroeker as its Chief Product Officer from HSBC. June also saw our integration with essDOCS deepen with an electronic bill of lading solution.

The next few months saw further transactions on the network. In August, Nanjing Iron & Steel expanded Contour’s engagement with China and the iron ore market, and in August, Contour facilitated the first blockchain-based Letter of Credit (LC) in Bangladesh – one of the largest LC markets in the world. Several key transactions took place over September, with Vale and Nanjing Iron & Steel, Bangkok Bank, the Asian Development Bank, Rio Tinto and Shenglong Metallurgical, all benefitting from Contour’s network.

October 2020 became a significant moment in our history. At the start of the month, the network rounded off its successful Beta phase and officially went into live production – offering its solution to banks and corporates globally, complete with a SAAS offering and a legal rulebook.

Following the launch, Contour continued to provide more options for banks and corporates looking to integrate Contour to their internal systems, leading to additional partnerships with Mphasis and CargoX.

This expansion of partners continued into November with TradeSun collaborating with Contour to offer banks the ability to turn documents into data using TradeSun’s OCR solution. We also confirmed our partnership with WAVE BL, a leading blockchain-based digital courier platform.

November also saw the Bank of China Hong Kong join our network and the first Japan-linked transaction with the Bank of Ayudhya take place. In December, Prime Bank completed a transaction on Contour and was proud to announce HSBC as our first production member.

As 2020 draws to a close, we continue to further our relationships with banks and corporates, offering a solution that can revolutionise the entire trade process.

Looking ahead

With all the activity we have experienced this year, the question remains: what’s next? As the business enters 2021, Contour will continue to build its relationships with banks, corporates, and technology partners, creating a solution that works for all. We also plan to solidify our role as a regular service for key industries and corridors, as well as expand to new markets and industries.

From there, we will look to build out different product sets, expanding beyond the LC to other key trade finance processes such as guarantees, standby LCs, collections, and open account trade loans. But that’s not all. The benefit of being on a network means that the banks and corporates working with us will have the ability to innovate and – as a community – to future-proof their processes as Contour offers the latest trends in digital trade.

This year has certainly been a significant one for many businesses, and Contour is no different. As we head into 2021, we will continue to deliver on our promises, enhance the processes around international trade and expand our network’s offering to ensure a better, stronger future for banks and corporates.

Next month, we look into the crystal ball and define what the future of trade finance looks like in 2023 and beyond. Get in touch with us to learn how Contour can help you streamline and transform your trade finance processes.