Contour’s digital and dynamic solution for letters of credit (LCs) has given banks and corporates around the world an alternative to a process largely unchanged for decades, but what about the participants involved in a letter of credit transaction – specifically, the role of an advising bank? Can it be changed in today’s digital world?

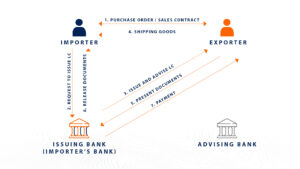

There are a minimum of three participants in an LC transaction – an applicant, a beneficiary and an issuing bank. Here’s a breakdown of the participants:

- Applicant: The buyer seeking goods or services from a supplier.

- Beneficiary: The seller seeking assurance of payment after delivery of their goods or services.

- Issuing Bank: A bank acting on behalf of the applicant, which provides a guarantee to the beneficiary that they pay the agreed-upon amount if the terms and conditions of the LC have been met.

While there are only three participants at a minimum, this is far from typical. As the issuing bank rarely has a relationship with the beneficiary, an advising bank is commonly used to act as an intermediary between the issuing bank and the beneficiary. It is responsible for verifying the authenticity of the LC and communicating its terms and conditions to the beneficiary. It does not provide any financial guarantees and is not a party to the underlying sales contract.

“Involving an advising bank in a letter of credit transaction can add to the time it takes for the transaction to be completed.” – Nainar

Advising Banks: A banking middleman

An advising bank has three key responsibilities. They are as follows:

- Beneficiary KYC

- Ensure that all the terms and conditions of the credit and any amendments are accurately communicated to the beneficiary

- To optionally facilitate the negotiation or collection of documents under the credit (depending on the specific terms of the credit)

As the advising bank is not liable for payment under the credit, it is important to note that the advising bank may not be able to provide the same level of support and assistance to the beneficiary as the issuing bank would be. Additionally, the advising bank is not a party to the letter of credit and may not have the same level of information or knowledge about the transaction as the issuing bank.

There are typically additional costs for the beneficiary or applicant when an advising bank is involved in a letter of credit transaction. For example, the advising bank may charge discrepancy and document handling fees, and for other services it provides in facilitating the transaction.

Involving an advising bank in a letter of credit transaction can also add to the time it takes for the transaction to be completed. Typically, the advising bank has to verify the authenticity of the LC and communicate its terms and conditions to the beneficiary. This process can be time-consuming, especially if there are any issues or discrepancies that need to be resolved. Being in different time zones also prolongs the communication and coordination in a transaction.

The ‘Directly-advised’ LC

However, in today’s digital world there is another option. Using a trusted communication platform – such as Contour – the issuing bank can directly advise the LC to the beneficiary, bypassing the need for an advising bank. This is known as a “Directly-advised LC” or a “Self-advised LC.” In this case, the issuing bank communicates the terms and conditions of the LC directly to the beneficiary, rather than relying on an advising bank to do so.

Roles & Risks: In the absence of an advising bank

In a scenario where an advising bank is absent, here’s what could happen during the various stages of an LC transaction on Contour.

Perform Beneficiary’s KYC

During the onboarding process, the identity of the beneficiary is independently verified to ensure that they are a legitimate entity. Depending on the location of the beneficiary and the requirements of the issuing bank, they can identify and communicate any potential risks or concerns directly with the beneficiary by reviewing the corporate documents, financial statements, and credit reports and so on.

Communication

The issuing bank takes on the responsibility for ensuring that all the terms and conditions of the credit and any amendments are accurately communicated to the beneficiary. Authenticated communication is very straight forward using a trusted network such as Contour.

Document Presentation

The beneficiary can present the required documents directly to the issuing bank through Contour. Upon receipt of the documents, the issuing bank reviews them to ensure that they are compliant with the terms and conditions of the LC. If the documents are clean, the issuing bank will accept or release the payment to the beneficiary according to the credits available by.

“Using a trusted communication platform – such as Contour – the issuing bank can directly advise the LC to the beneficiary, bypassing the need for an advising bank.” – Nainar

What are the beneficiary’s risks?

Every LC transaction carries some level of risk, whether its credit, political or fraud risk. There is always the risk an issuing bank may not have sufficient funds to pay the beneficiary when the time comes, or political events in the issuing bank’s country may impact its ability to make payment, and the risk that a LC may be fraudulent.

In some transactions, the beneficiary will not want to accept the credit and political risks associated with the issuing bank and may request having a confirming bank involved in the transaction to mitigate credit and political risks. This adds an additional layer of protection, as the confirming bank will pay the beneficiary if the issuing bank fails to do so. Confirmations from a third-party bank can be easily added on Contour if required.

To mitigate fraud risk, the identities of the issuing bank and applicant are verified by Contour during the onboarding process to ensure they are legitimate entities.

The advantages of not having an advising bank

Ultimately, it comes down to whether the benefits outweigh the costs of eliminating an advising bank, and there are three distinct advantages.

Firstly, cost reduction. Banks typically charge fees of between $30-$80 for customers and $60-$120 for non-customers per event related to advising and amending an LC. By eliminating the advising bank, hundreds of dollars in advising fees can be saved.

Secondly, increasing the speed and efficiency of the process. On Contour, there is no need for the advising bank to verify the authenticity of the LC or to communicate its terms and conditions to the beneficiary. This reduces the time it takes for the beneficiary to receive the LC and for the transaction to be completed, hence, speeding up the process

Lastly, enhancing the security of the transaction. As the issuing bank has direct control of communications of the LC to the beneficiary, it increases the security of the transaction. With an advising bank, there is a risk of miscommunication or misunderstanding, as the advising bank may not have the same level of knowledge or information about the transaction as the issuing bank.

Before the digital revolution, LC transactions were processed manually, and the use of an advising bank was necessary to ensure proper communication, verification of the LC and to deliver the paper locally.

Since the introduction of trade finance networks like Contour, it is now possible to conduct LC transactions electronically, allowing the issuing bank to directly advise the LC to the beneficiary, bypassing the need for an advising bank. This in turn can lead to reduced costs, increased speed and efficiency, and most importantly, increased security. Market practices in the Asia Pacific and Middle East regions show that some banks have already started offering self-advised LCs and this practice is only set to grow.

Do you agree that the role of the advising bank should be removed? Share your thoughts with us on our LinkedIn post.